WSIB, or the Workplace Safety and Insurance Board, is an independent agency of the Ontario government. It provides workers’ compensation benefits to employees who have been injured or become ill due to their work. It also provides no-fault insurance for employers to protect them from lawsuits related to workplace injuries or illnesses. WSIB is funded by employer premiums and is responsible for administering the Workplace Safety and Insurance Act. It is one of the largest insurance organizations in North America. It covers over five million people in more than 300 000 workplaces across Ontario.

The values of trust, integrity, compassion and helpfulness, are the foundation of the WSIB’s Code of Business Ethics, (COBE), and it’s corresponding program. WSIB’s vision is to make Ontario one of the healthiest and safest places to work. WSIB believes a big part of that effort is the support they provide to people who have suffered a work-related injury of illness. They help them as they recover and safely return to work.

The Importance of WSIB

- It is an essential part of the Canadian workforce. It ensures that employees are protected in case of a workplace injury or illness.

- It also helps employers by providing them with insurance coverage and preventing costly lawsuits.

- It also plays a crucial role in promoting workplace safety and preventing accidents and injuries.

- It helps create a safer work environment for all employees. By enforcing safety regulations and providing resources for workplace safety.

How WSIB Works

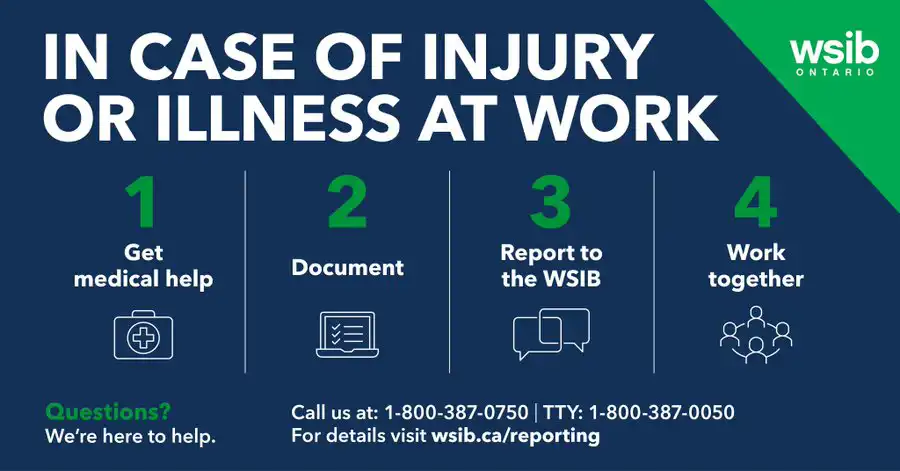

When an employee is injured or becomes ill due to their work, they can file a claim with WSIB for compensation. This can include medical treatment, lost wages, and other benefits. An employee must immediately report his/her injury, or illness related to the workplace, to his/ her employer. Employers are required to report any workplace injuries or illnesses to WSIB within three days of the incident. All forms to be filed are time sensitive.

They then investigate the claim and determines if the employee is eligible for benefits. If the claim is approved, and the employee is unable to work, they will cover the costs of the employee’s medical treatment, and provide wage replacement. An employee may be deemed to be placed back to work with modified duties if possible. WSIB will continue to work with the employer to lower risks of re-occurrence in the workplace.

How to Apply for WSIB for your Business

To apply for WSIB coverage for your business, follow these steps:

- Determine eligibility: Ensure that your business falls under the WSIB coverage. Most businesses in Ontario, Canada, are required to have coverage for their employees.

- Register your business: Register your business with the Workplace Safety and Insurance Board (WSIB). You can do this online through the WSIB website or by completing the necessary forms and submitting them by mail.

- Provide business information: When registering, you will need to provide information about your business, such as its legal name, business address, contact details, industry classification, and the number of employees you have.

- Determine the premium rate: WSIB calculates the premium rates based on the industry classification of your business and the total insurable earnings of your employees. The premium rate is a percentage of the insurable earnings and varies depending on the industry.

- Pay the premiums: Once your business is registered, you will need to pay the premiums to maintain your WSIB coverage. The premiums are typically paid quarterly or annually, depending on the payment plan you choose.

- Report any workplace injuries or illnesses: As an employer, you have a legal obligation to report any workplace injuries or illnesses to WSIB. This should be done within three days of the incident or as soon as reasonably possible.

- Cooperate with WSIB investigations: If a workplace injury or illness occurs, you may be required to cooperate with WSIB investigations. This includes providing any necessary documentation or information requested by WSIB.

- Maintain accurate records: It is important to keep accurate records of your employees, their earnings, and any workplace incidents. This information may be required by WSIB for premium calculations and claims processing.

Remember, it is always recommended to consult with WSIB or seek legal advice for specific questions or concerns regarding WSIB coverage for your business.

What are the Steps for WSIB Claims

- Report the injury or illness: The first step is to report the workplace injury or illness to your employer as soon as possible. It’s important to notify your employer within the specified time frame, usually within 6 months of the incident.

- Seek medical attention: After reporting the injury or illness, seek medical attention from a healthcare provider. They will assess your condition and provide the necessary treatment.

- Complete the FAF WSIB Form: The Functional Abilities Form (FAF) mentioned in the article needs to be completed by your healthcare provider. This form helps WSIB assess your functional abilities and determine your eligibility for benefits.

- Submit the claim to WSIB: Once the FAF form is completed, you or your employer need to submit the claim to the Workplace Safety and Insurance Board (WSIB). This can be done online or by mail.

- WSIB review and decision: After receiving the claim, WSIB will review the information provided, including the FAF form and any other relevant documents. They will assess your eligibility for benefits and make a decision on your claim.

- Benefit payments: If your claim is approved, WSIB will provide you with workers’ compensation benefits, which may include wage replacement and coverage for medical expenses. The amount and duration of benefits will depend on the severity of your injury or illness.

- Return to work planning: If you are unable to return to your regular job due to your injury or illness, WSIB will work with you, your employer, and healthcare provider to develop a return-to-work plan. This plan aims to help you gradually return to suitable work.

- Appeals process: If your claim is denied or you disagree with the decision made by WSIB, you have the right to appeal. You can request a review of your claim and provide additional information to support your case.

Remember, it’s always important to consult with WSIB or seek legal advice if you have any specific questions or concerns regarding your WSIB claim.

FAF WSIB Form

The FAF WSIB form (or the Functional Abilities Form), is a document used by WSIB to assess an employee’s functional abilities after a workplace injury or illness. This form is completed by the employee’s healthcare provider. Which helps WSIB determine the employee’s eligibility for benefits, and the level of support they require. The FAF WSIB form is an essential part of the claims process. It helps ensure that employees receive the appropriate benefits and support. You can find the form here.

What Types of Health Care Benefits does WSIB Offer?

They offer the following health care benefits:

- Medical treatment

- Hospitalization, including emergency care and surgery

- Prescription drugs

- Medical devices and orthotics

- Equipment and supplies

- Reasonable travel and accommodation expenses associated with your work-related injury or illness

These benefits aim to provide comprehensive support to injured or ill employees in their recovery process.

Conclusion

WSIB is a vital organization that plays a crucial role in protecting employees and employers in the Canadian workforce. It provides workers’ compensation benefits for injured or ill employees and insurance coverage for employers. WSIB also promotes workplace safety and offers resources and support for employers to create a safe work environment. By understanding what WSIB is and how it works, both employees and employers can benefit from this important organization.

Employment North is able to assist you in learning more about this important insurance and coverage organization. The content of this article is accurate to the best of our knowledge at the time of posting. Always double check with your employer or WSIB.